UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

Vontier Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required | |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

VONTIER CORPORATION

5438 Wade Park Boulevard, Suite 600

Raleigh, North Carolina 27607

Notice of 2022 Annual Meeting of Stockholders

|

|

| ||||||

When: May 25, 2022 at 8:00 a.m. ET

Where: Online only via live webcast | Items of Business: 5 proposals as listed below

Date of Mailing: The date of mailing of this Proxy April 8, 2022. | Who Can Vote: Stockholders of Vontier’s common |

Items of Business:

| 1. | To elect Messrs. Robert L. Eatroff, Martin Gafinowitz and Andrew D. Miller to serve as directors for the term expiring at the 2025 annual meeting of stockholders and until their successors have been elected and qualified. |

| 2. | To ratify the selection of Ernst & Young LLP as Vontier’s independent registered public accounting firm for the year ending December 31, 2022. |

| 3. | To approve, on an advisory basis, Vontier’s named executive officer compensation as disclosed in this proxy statement. |

| 4. | To amend Vontier’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors. |

| 5. | To amend Vontier’s Amended and Restated Certificate of Incorporation to eliminate supermajority provisions. |

| 6. | To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Most stockholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card or voting instruction form. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 25, 2022:

We are pleased to take advantage of the U.S. Securities and Exchange Commission rules that allow us to furnish these proxy materials and our 2022 Annual Report to Stockholders, including financial statements, via the Internet. On or about April 8, 2022, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and 2022 Annual Report to Stockholders and how to vote. We believe that posting these materials on the Internet enables us to provide stockholders with the information they need to vote more quickly, while lowering the cost and reducing the environmental impact of printing and delivering annual meeting materials. The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: www.proxyvote.com.

By Order of the Board of Directors,

Courtney S. Kamlet

Corporate Secretary

April 8, 2022

| 2022 Proxy Statement | i |

| 31 | ||||

| 32 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

Potential Payments Upon Termination or Change-of-Control as of 2021 Fiscal Year-End | 46 | |||

| 47 |

| 48 | ||||

| 49 | ||||

| 50 | ||||

Proposal 4. Amend Certificate of Incorporation to Declassify the Board of Directors | 51 | |||

Proposal 5. Amend Certificate of Incorporation to Eliminate Supermajority Vote Provisions | 52 | |||

| 53 | ||||

| 53 | ||||

| 54 |

| ii | 2022 Proxy Statement |  |

| Proxy Statement Summary | ||||

To assist you in reviewing the proposals to be acted upon at our 2022 Annual Meeting, below is a summary of information regarding the meeting contained elsewhere in this Proxy Statement. The following description is only a summary. For more information about these topics, please review the complete Proxy Statement.

2022 Annual Meeting of Stockholders

| Date and time: | May 25, 2022 at 8:00 a.m. ET | |

| Place: | www.virtualshareholdermeeting.com/VNT2022 | |

| Record date: | March 24, 2022 | |

| Voting: | Stockholders of Vontier’s common stock at the close of business on March 24, 2022 are entitled to one vote per share of common stock on each matter to be voted upon at the 2022 Annual Meeting of Stockholders (“Annual Meeting”) |

Items of Business

Proposal | Vote Required | Board Recommendation | ||

Proposal 1: Election of Messrs. Robert L. Eatroff, Martin Gafinowitz and Andrew D. Miller to serve as directors until 2025 | For each nominee, majority of votes cast. | FOR each nominee | ||

Proposal 2: Ratification of the selection of Ernst & Young LLP as Vontier’s independent registered public accounting firm for the year ending December 31, 2022 | The affirmative vote of a majority of the shares represented in person or by proxy. | FOR | ||

Proposal 3: Approval, on an advisory basis, of Vontier’s named executive officer compensation as disclosed in this proxy statement | The affirmative vote of a majority of the shares represented in person or by proxy. | FOR | ||

Proposal 4: To amend Vontier’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors | The affirmative vote of the holders of at least two-thirds of total voting power of outstanding shares of Vontier’s Common Stock entitled to vote on this proposal. | FOR | ||

Proposal 5. To amend Vontier’s Amended and Restated Certificate of Incorporation to eliminate supermajority provisions | The affirmative vote of the holders of at least two-thirds of total voting power of outstanding shares of Vontier’s Common Stock entitled to vote on this proposal. | FOR | ||

| 2022 Proxy Statement | 1 |

Proxy Statement Summary

Corporate Governance Highlights

Our Board of Directors (the “Board”) recognizes that enhancing and protecting long-term value for our stockholders requires a robust framework of corporate governance that serves the best interests of all our stockholders.

In connection with our Board’s dedication to strong corporate governance, our Board has implemented the following corporate actions:

Our Corporate Governance Framework

|

We have documented and executed our commitment to Board diversity in our Corporate Governance Guidelines and our Nominating and Governance Committee Charter

|  |

We have an Environmental, Social and Governance (“ESG”) program, with program oversight by the Board and reporting oversight by the Nominating and Governance Committee

| |||||||||||

|

Our Audit Committee Charter includes oversight of our cybersecurity

|  |

We have stock ownership requirements for non-CEO executive officers at a multiple of three times base salary and for CEO and directors at a multiple of five times base salary and annual cash retainer, respectively

| |||||||||||

|

Our Chair and CEO positions are separate, with an independent Chair

|  |

We maintain a majority vote requirement for the election of directors in uncontested elections

| |||||||||||

|

We have an anti-overboarding policy that limits the number of boards of other public companies on which our directors may serve to four

|  |

We have no shareholder rights plan

| |||||||||||

| 2 | 2022 Proxy Statement |  |

Proxy Statement Summary

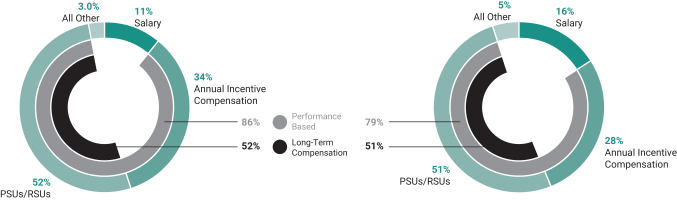

2021 Pay Mix

| CEO Pay | All Other NEO Pay |

Compensation Governance Highlights

What We Do | ||

| Core Executive Compensation Principles Designed to Promote Shareholder Value | |

| Performance Measures Aligned with Business Objectives | |

| Pay for Performance | |

| Maintain Stock Ownership Requirements | |

| Maintain a Compensation Recoupment Policy | |

| Maintain Market Competitive Vesting Schedules for Equity Awards | |

| Require Minimum Vesting Schedule under our Equity Plan | |

| Monitor for Risk-Taking Incentives | |

| Engage an Independent Compensation Consultant | |

| Limit Perquisites | |

|

Introduced Performance-Based Equity Awards in 2020 and Continued to Include that as a Component of the 2022 Long-Term Incentive Award for Executive Officers | |

What We Don’t Do | ||

| No Excise Tax Gross-Ups | |

| No “Single-Trigger” | |

| No Pledging of our Common Stock by Executive Officers | |

| No Hedging Transactions by Executive Officers | |

| No Evergreen Provision in Stock Incentive Plan | |

| No Repricing of Stock Options | |

| No Liberal Share Recycling under Stock Incentive Plan | |

| No Liberal Definition of | |

| No Defined Benefit Plans for Executive Officers | |

| 2022 Proxy Statement | 3 |

| Proxy Statement | ||||

2022 Annual Meeting of Stockholders

May 25, 2022

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Vontier Corporation, a Delaware corporationCorporation (“Vontier” or the “Company”), of proxies for use at the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 25, 2022 at 8:00 a.m. ET, and at any and all postponements or adjournments thereof. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/VNT2022 and entering your 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card (the “Proxy Card”) or on the instructions that accompanied your proxy materials.

The purpose of the meeting is:

| 1. | To elect Messrs. Robert L. Eatroff, Martin Gafinowitz and Andrew D. Miller to serve as directors, each for a term expiring at the 2025 annual meeting and until their successors have been elected and qualified. |

| 2. | To ratify the selection of Ernst & Young LLP as Vontier’s independent registered public accounting firm for the year ending December 31, 2022. |

| 3. | To approve, on an advisory basis, Vontier’s named executive officer compensation as disclosed in this proxy statement. |

| 4. | To amend Vontier’s Amended and Restated Certificate of Incorporation to declassify the Board. |

| 5. | To amend Vontier’s Amended and Restated Certificate of Incorporation to eliminate supermajority provisions. |

| 6. | To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

Who Can Attend the Annual Meeting

The Annual Meeting will be held entirely online to allow for greater participation. You may attend the Annual Meeting online only if you are a Vontier stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. You may attend and participate in the Annual Meeting by visiting the following website www.virtualshareholdermeeting.com/VNT2022. To attend and participate in the Annual Meeting, you will need the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your Proxy Card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. The meeting webcast will begin promptly at 8:00 a.m. ET. We encourage you to access the meeting prior to the start time. Online check-in will begin at 7:50 a.m. ET, and you should allow ample time for the check-in procedures.

Asking Questions. Stockholders have multiple opportunities to submit questions to Vontier for the annual meeting. Stockholders who wish to submit a question in advance may do so at www.proxyvote.com. Stockholders also may submit questions during the meeting. Stockholders can also access copies of the proxy statement and annual report at our annual meeting website.

Technical Issues. If any Stockholder is having technical difficulties joining the Annual Meeting, the technical support numbers will be located on the login page of www.virtualshareholdermeeting.com/VNT2022.

Outstanding Stock and Voting Rights

In accordance with Vontier’s Amended and Restated Bylaws, the Board has fixed the close of business on March 24, 2022 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on that date will be entitled to vote. The only outstanding securities of Vontier entitled to vote at the Annual Meeting are shares of common stock, $0.0001 par value (“Common Stock”). Each outstanding share of Common Stock entitles the holder to one vote on each directorship and other matter brought before the Annual Meeting. As of the close of business on March 24, 2022, 160,998,628161,001,712 shares of Common Stock were outstanding, excluding shares held by or for the account of Vontier.

| 4 | 2022 Proxy Statement |  |

Proxy Statement

We bear the expense of soliciting proxies. Our directors, officers, or employees may also solicit proxies personally or by telephone, e-mail, facsimile, or other means of communication. We do not intend to pay additional compensation for doing so. In addition, we have engaged Okapi Partners LLC (“Okapi Partners”) to assist in the solicitation of proxies for the Annual Meeting and we estimate we will pay Okapi Partners a fee of approximately $15,000. We have also agreed to reimburse Okapi Partners for reasonable administrative and out-of-pocket expenses incurred in connection with the proxy solicitation and indemnify Okapi Partners against certain losses, costs and expenses. Additionally, we will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries representing beneficial owners of our common stock, for their expenses in forwarding soliciting materials to those beneficial owners.

Proxies will be voted as specified in the proxy.

If you sign and submit your Proxy Card with no further instructions, your shares will be voted:

| FOR the election of each of Messrs. Robert L. Eatroff, Martin Gafinowitz and Andrew D. Miller to serve as directors, until the 2025 annual meeting; | |

| FOR ratification of the selection of Ernst & Young LLP as Vontier’s independent registered public accounting firm for the year ending December 31, 2022; | |

| FOR approval of the Company’s named executive officer compensation as disclosed in this proxy statement; | |

| FOR amendment of Vontier’s Amended and Restated Certificate of Incorporation to declassify the Board; | |

| FOR amendment of Vontier’s Amended and Restated Certificate of Incorporation to eliminate supermajority provisions; and | |

| In the discretion of the proxy holders on any other matter that properly comes before the meeting or any adjournment thereof. The Board has selected Kathryn K. Rowen and Courtney S. Kamlet to act as proxies with full power of substitution. | |

Notice of Electronic Availability of Proxy Materials

As permitted by the U.S. Securities and Exchange Commission (“SEC”) rules, we are making the proxy materials available to our stockholders primarily via the Internet. By doing so, we can reduce the printing and delivery costs and the environmental impact of the Annual Meeting. On or about April 8, 2022, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. The Notice contains instructions on how to access our proxy materials and how to vote online or by telephone. If you would like to receive a paper copy of the proxy materials, please follow the instructions in the Notice.

Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement

Quorum. The quorum necessary to conduct business at the Annual Meeting consists of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting as of the record date. Abstentions and broker non-votes will be counted as present in determining whether the quorum requirement is satisfied.

Broker Non-Votes. Under New York Stock Exchange (“NYSE”) rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote those shares on Proposal 2, which is considered a “routine” matter. However, on “non-routine” matters such as Proposals 1, 3, 4 and 5, your broker must receive voting instructions from you, as it does not have discretionary voting power for these particular items. Therefore, if you are a beneficial owner and do not provide your broker with voting instructions, your shares may constitute broker non-votes with respect to Proposals 1, 3, 4 and 5. Broker non-votes will not affect the required vote with respect to Proposals 1 and 3. Broker non-votes will have the same effect as votes against Proposals 4 and 5.

| 2022 Proxy Statement | 5 |

Proxy Statement

Approval Requirements. If a quorum is present, the vote required under the Company’s Amended and Restated Bylaws and the Amended and Restated Certificate of Incorporation to approve each of the proposals is as follows:

With respect to Proposal 1, the election of directors, you may vote “for” or “against” any or all director nominees or you may abstain as to any or all director nominees. In uncontested elections of directors, such as this election, a nominee is elected by a majority of the votes cast by the shares present in person or represented by proxy and entitled to vote. A “majority of the votes cast” means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee. A vote to abstain is not treated as a vote “for” or “against,” and thus will have no effect on the outcome of the vote.

With respect to Proposals 2 and 3, the affirmative vote of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal.

With respect to Proposals 4 and 5, the affirmative vote of the holders of at least two-thirds of the total voting power of outstanding shares of the Company’s Common Stock entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal.

Tabulation of Votes. Our inspector of election, Broadridge Financial Services, will tabulate votes cast by proxy or in person at the meeting. We will report the results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the registered holder of those shares. As the registered stockholder, you can ensure your shares are voted at the Annual Meeting by submitting your instructions by telephone, over the internet,Internet, by completing, signing, dating and returning the enclosed Proxy Card in the envelope provided, or by attending the Annual Meeting and voting your shares at the meeting. Telephone and internetInternet voting for registered stockholders will be available 24 hours a day, up until 11:59 p.m., ET on May 24, 2022.

As a stockholder of record, you may vote by proxy in any one of the following ways:

Via the Internet by accessing the proxy materials on the secured website www.proxyvote.com and following the voting instructions on that website;

Via telephone by calling toll free 1-800-690-6903 and following the recorded instructions; or

Via mail by completing, dating, signing and returning the Proxy Card. Please allow sufficient time for delivery of your Proxy Card if you decide to vote by mail.

To participate in the Annual Meeting, including to vote via the Internet or telephone, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your Proxy Card, or on the instructions that accompanied your proxy materials. Voting via the Internet or telephone must be completed by 11:59 p.m. ET on May 24, 2022. If you submit or return a Proxy Card without giving specific voting instructions, your shares will be voted as recommended by the Board, as permitted by law.

If your shares are held in a brokerage account or by another nominee or trustee, you are considered the beneficial owner of shares. In that case, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Telephone and Internet voting may be offered to stockholders owning shares through certain banks and brokers. If your shares are not in your own name and you would like to vote your shares electronically at the Annual Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date.

| 6 | 2022 Proxy Statement |  |

Proxy Statement

If you hold your shares through a broker, bank or nominee, rather than registered directly in your name, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank or nominee, together with a voting instruction form. As the beneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which the beneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction forms.

If you participate in the Vontier Stock Fund through either of the Savings Plans, your proxy will also serve as a voting instruction for Fidelity Management Trust Company (“Fidelity”), the trustee of the Savings Plans, with respect to shares of Common Stock attributable to your Savings Plan account as of the record date. Fidelity will vote your Savings Plan shares as of the record date in the manner directed by you. If Fidelity does not receive voting instructions from you by May 20, 2022, Fidelity will not vote your Savings Plan shares on any of the proposals brought at the Annual Meeting.

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of Vontier a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or nominee and you wish to revoke your proxy or vote at the meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a proxy issued in your name. Attendance at the meeting will not, by itself, revoke a proxy.

We are permitted by the SEC to send a single copy of our Notice of Internet Availability and, if you requested printed versions by mail, the set of our proxy statement and annual report to stockholders who share the same last name and address. This procedure is called “householding” and is intended to reduce our printing and postage costs. We will promptly deliver a separate copy of our Notice of Internet Availability and, if you requested printed versions by mail, our annual report and proxy statement to you if you contact us at Vontier Corporation, Attn: Investor Relations, 5438 Wade Park Boulevard, Suite 600, Raleigh, North Carolina 27607; telephone us at (984) 275-6000; or email us at investor.relations@vontier.com. In addition, if you want to receive separate copies of the proxy statement or annual report in the future; if you and another shareholder sharing an address are receiving more than one copy of the proxy materials and would like to request delivery of a single copy of the proxy statement or annual report at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials and annual report in the future, you may contact us at the same address, telephone number or email address. If you hold your shares through a broker or other intermediary and would like additional copies of our proxy statement or annual report or would like to request householding, please contact your broker or other intermediary.

| 2022 Proxy Statement | 7 |

| Beneficial Ownership of Common Stock by Directors, Officers and | ||||

| Principal Shareholders | ||||

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 1,March 24, 2022, unless otherwise noted below, for the following:

each person or entity known to own beneficially more than 5% of our outstanding common stock as of the date indicated in the corresponding footnote;

each member of our Board and each of our named executive officers (“NEOs”); and

all current members of our Board and our executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the SEC, based on factors including voting and investment power with respect to shares. Common stock subject to stock options currently exercisable, or exercisable within 60 days after March 24, 2022, are deemed outstanding for the purpose of computing the percentage ownership of the person holding those stock options, but are not deemed outstanding for computing the percentage ownership of any other person. Unless otherwise indicated, the address for each listed stockholder is c/o Vontier Corporation, 5438 Wade Park Boulevard, Suite 600, Raleigh, North Carolina 27607. Each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

| Common Stock Beneficially Owned | ||||||||

Name and Address of Beneficial Owner | Number of Shares of Common Stock | Percentage of Common Stock Outstanding (%) | ||||||

5% Beneficial Owner | ||||||||

The Vanguard Group 100 Vanguard Way, Malvern, PA 19355 | 15,661,382 | (1) | 9.4 | |||||

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | 14,440,138 | (2) | 8.5 | |||||

Directors and Executive Officers | ||||||||

Gloria R. Boyland | 19,373 | (3) | * | |||||

Robert L. Eatroff | 13,128 | (4) | * | |||||

Karen C. Francis | 47,939 | (5) | * | |||||

Martin Gafinowitz | 22,214 | (6) | * | |||||

Christopher J. Klein | 13,086 | (7) | * | |||||

Andrew D. Miller | 19,373 | (8) | * | |||||

Mark D. Morelli | 357,009 | (9) | * | |||||

Maryrose Sylvester | 10,330 | (10) | * | |||||

David H. Naemura | 264,879 | (11) | * | |||||

Andrew Nash | 129,097 | (12) | * | |||||

Kathryn K. Rowen | 53,728 | (13) | * | |||||

All Directors and Executive Officers as a Group (eleven persons) | 950,156 | (14) | * | |||||

| (1) | The amount shown and the following information is derived from a Schedule 13G/A filed February 10, 2022 by The Vanguard Group which sets forth their beneficial ownership as of December 31, 2021. According to the Schedule 13G/A, The Vanguard Group has shared voting power over 90,561 shares, sole dispositive power over 15,661,382 shares and shared dispositive power over 226,940 shares. |

| (2) | The amount shown and the following information is derived from a Schedule 13G filed February 3, 2022 by BlackRock, Inc. which sets forth BlackRock, Inc.’s beneficial ownership as of December 31, 2021. According to the Schedule 13G, BlackRock, Inc. has sole voting power over 13,962,987 shares and sole dispositive power over 14,440,138 shares. |

| (3) | Includes options to acquire 10,550 shares. |

| (4) | Includes options to acquire 3,714 shares. |

| 8 | 2022 Proxy Statement |  |

Beneficial Ownership of Common Stock by Directors, Officers and Principal Shareholders

| (5) | Includes options to acquire 23,680 shares. |

| (6) | Includes options to acquire 10,550 shares. |

| (7) | Includes options to acquire 5,826 shares. |

| (8) | Includes options to acquire 10,550 shares. |

| (9) | Includes options to acquire 243,356 shares and 9,183 notional phantom shares attributable to Mr. Morelli’s EDIP account. |

| (10) | Includes options to acquire 3,750 shares. |

| (11) | Includes options to acquire 212,954 shares and 6,648 notional phantom shares attributable to Mr. Naemura’s EDIP account. |

| (12) | Includes options to acquire 112,896 shares and 8,336 notional phantom shares attributable to Mr. Nash’s EDIP account. |

| (13) | Includes options to acquire 43,364 shares and 2,792 notional phantom shares attributable to Ms. Rowen’s EDIP account. |

| (14) | Includes options to acquire 361,966 shares and 26,959 notional phantom shares attributable to EDIP accounts. |

| * | Represents less than 1% of the outstanding Common Stock. |

| 2022 Proxy Statement | 9 |

| Proposal 1. Election of Directors | ||||

Our Board currently consists of eight members and is divided into three classes, the members of which each serve for a staggered three-year term and until a successor has been elected and qualified. The term of office of one class of directors expires each year in rotation so that one class is elected at each annual meeting for a full three-year term.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of common stock represented by the proxy for the election as Class I directors of the persons whose names and biographies appear below, each of whom is currently a director and each of whom has consented to be named in this Proxy Statement and to serve if elected. In the event that any nominee is unable to serve or for good cause will not serve as a director at the time of the meeting, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. We do not expect that any nominee will be unable or will decline to serve as a director. If you are a beneficial owner of shares held in street name and you do not provide your broker with voting instructions, your broker may not vote your shares on the election of directors. Therefore, it is important that you vote.

The name of and certain information regarding each Class II director nominee is set forth below, together with information regarding our directors remaining in office. This information is based on data furnished to us by the nominees and directors. There is no family relationship between any director, executive officer or person nominated to become a director or executive officer. The business address for each nominee and director for matters regarding the Company is 5438 Wade Park Boulevard, Suite 600, Raleigh, North Carolina 27607.

At the Annual Meeting, stockholders will be asked to elect each of the current Class II director nominees identified below (each of whom has been recommended by the Nominating and Governance Committee, nominated by the Board and currently serves as a Class II Director of the Company) to serve until the 2025 Annual Meeting of Stockholder and until his or her successor is duly elected and qualified.

As discussed in greater detail in Proposal 4, on December 8, 2021, the Board unanimously approved an amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board and to provide, after a sunset period, for the annual election of directors, subject to the approval by the stockholders at the Annual Meeting. If Proposal 4 is approved by the requisite vote of the stockholders:

The Class III directors elected at the 2023 Annual Meeting of Stockholders will be elected (and at each annual meeting thereafter) for one-year terms;

Beginning with the 2024 Annual Meeting of Stockholders, a majority of the directors will be elected annually; and

Beginning with the 2025 Annual Meeting of Stockholders, all directors will be elected annually.

Our directors are comprised of current directors with diverse skills, background, and experience, which the Board believes contributes to the effective oversight of the Company.

Gender

| Ethnicity/Race

| Independence

|

| 10 | 2022 Proxy Statement |  |

Proposal 1. Election of Directors

Director Nominees – For Terms Expiring at this Annual Meeting and Subsequent Terms Expiring in 2025

Class II Directors with Terms Expiring in 2022

Name | Age | Position with Vontier | Director Since | |||||

Robert L. Eatroff |

| 56 |

| Director | March 2021 | |||

Martin Gafinowitz |

| 63 |

| Director | October 2020 | |||

Andrew D. Miller |

| 61 |

| Director | October 2020 | |||

The Board of Directors recommends that stockholders vote “FOR” the election to the Board of each of the foregoing Director Nominees.

| VOTE FOR

|

| 2022 Proxy Statement | 11 |

Proposal 1. Election of Directors

Class II Directors with Terms Expiring in 2022

Name | Age | Position with Vontier | Director Since | |||||

Robert L. Eatroff |

| 56 |

| Director | March 2021 | |||

Martin Gafinowitz |

| 63 |

| Director | October 2020 | |||

Andrew D. Miller |

| 61 |

| Director | October 2020 | |||

Robert L. Eatroff

Director

Age: 56 Director Since: March 2021 Committees: Audit |

Robert L. Eatroff has served as a member of our Board of Directors since March 2021. As Executive Vice President of Global Corporate Development and Strategy for Comcast Corporation since January 2016, Mr. Eatroff manages Comcast NBCUniversal’s Corporate Development and leads its mergers and acquisitions (“M&A”) efforts and other strategic initiatives. Prior to joining Comcast, Mr. Eatroff spent more than 20 years at Morgan Stanley’s investment banking division, where he served as lead advisor on some of the firm’s largest and most high-profile M&A transactions and held many leadership positions, including Managing Director, Investment Banking Division and Head-Mergers and Acquisitions-Americas. |

Mr. Eatroff brings significant experience in capital allocation and M&A to the Vontier board. | ||||||

Martin Gafinowitz

Director

Age: 63 Director Since: October 2020 Committees: None |

Martin Gafinowitz has served as a member of our Board of Directors since September 2019. Mr. Gafinowitz has over 25 years of international and industry experience, most recently having global responsibility for Fortive Corporation’s transportation technologies and franchise distribution platforms as Senior Vice President of Fortive Corporation from July 2016 to October 2020. Prior to July 2016, Mr. Gafinowitz has a long history as a senior executive with Danaher Corporation (“Danaher”) and its operating companies. Mr. Gafinowitz served as Senior Vice President of Danaher from March 2014 to July 2016 after serving as Group Executive of Danaher from 2005 to March 2014. |

Mr. Gafinowitz brings to our Board extensive prior M&A and operational experience in our businesses and long tenured mobility industry relationships from his service as a Senior Vice President of Fortive and of Danaher. | ||||||

| 12 | 2022 Proxy Statement |  |

Proposal 1. Election of Directors

Andrew D. Miller

Director

Age: 61 Director Since: October 2020 Committees: Audit (Chair), Compensation and Management Development |

Andrew D. Miller has served as a member of our Board of Directors since October 2020 and has served on the Board of Directors of iRobot Corporation since September 2016 where he is the chair of the Audit Committee and a member of the Nominating and Governance Committee. Mr. Miller has also served as a member of the Audit Committee of the Board of Directors of Verint Systems Inc., a global software and cloud provider of Actionable Intelligence solutions, since December 2019. Mr. Miller previously served as Executive Vice President and Chief Financial Officer of PTC, a provider of software technology platforms and solutions, from early 2015 until May 2019. At PTC, he was responsible for global finance, tax and treasury, investor relations, information technology, pricing, corporate real estate, and customer administration. From 2008 to 2015, Mr. Miller served as Chief Financial Officer of Cepheid, a high-growth molecular diagnostics company. While at Cepheid, he built world-class finance and information technology teams and a nationally recognized investor relations program. Mr. Miller has also served in financial leadership roles at Autodesk, MarketFirst Software, Cadence Design Systems, and Silicon Graphics. He is a former director of United Online. |

Mr. Miller brings to our Board his extensive experience in financial leadership roles, significant experience in investor relations and background in software and information technology. | ||||||

Class III Directors with Terms Expiring in 2023

Name | Age | Position with Vontier | Director Since | |||||

Gloria R. Boyland |

| 61 |

| Director | October 2020 | |||

Christopher J. Klein |

| 58 |

| Director | December 2020 | |||

Maryrose Sylvester |

| 56 |

| Director | March 2021 | |||

| 2022 Proxy Statement | 13 |

Proposal 1. Election of Directors

Gloria R. Boyland

Director

Age: 61 Director Since: October 2020 Committees: Audit, Nominating and Governance (Chair) |

Gloria R. Boyland has served as a member of our Board of Directors since October 2020 and currently serves as a strategic advisor of Aurora Technologies, LLC, a position she has held since June 2020. Ms. Boyland serves on the Board of Directors of United Natural Foods, Inc. (NYSE: UNFI) and is a member of the |

Ms. Boyland brings to our Board significant operational and logistical experience. In addition, through her leadership role with a large, global company in the transportation industry, she has insight into the business practices that are critical to the success of Vontier. | ||||||

Christopher J. Klein

Director

Age: 58 Director Since: December 2020 Committees: Compensation and Management Development (Chair), Nominating and Governance |

Christopher J. Klein has served as a member of our Board of Directors since December 2020 and as a member of the Board of Directors of Thor Industries (NYSE: THO) since December 2017 and is a member of its Nominating and Compensation and Developments Committees. Mr. Klein served as the Executive Chairman of the Board of Directors of Fortune Brands Home & Security, Inc., a leading manufacturer of home and security products until December 2020, having retired as Chief Executive Officer in January 2020. He joined Fortune Brands, Inc. in 2003 and held corporate strategy, business development and operational positions, and served in the role of Chief Executive Officer of Fortune Brands Home & Security from 2010 to January 2020, taking the company public in a spin-off in 2011. Prior to joining Fortune Brands, Inc., Mr. Klein held key strategy and operating positions at Bank One Corporation. Previously, he was a partner at McKinsey & Company, a global management consulting firm where he spent eight years in the firm’s Chicago office. Mr. Klein spent his early career in commercial banking, at both ABN / AMRO and First Chicago. |

Mr. Klein brings to our Board extensive public company and operational leadership experience, including management experience as Chief Executive Officer of a public company as well as significant corporate strategy experience. | ||||||

| 14 | 2022 Proxy Statement |  |

Proposal 1. Election of Directors

Maryrose Sylvester

Director

Age: 56 Director Since: March 2021 Committees: Audit, Nominating and Governance |

Since 2016, Ms. Sylvester has served on the board of Harley-Davidson, Inc. (NYSE: HOG) and is a member of its Human Resources and Nominating and Corporate Governance Committees. Since March 2021, Ms. Sylvester has served on the board of Waste Management, Inc. (NYSE: WM) and is a member of its Management Development and Compensation Committee. From June 2019 to August 2020, Ms. Sylvester was the U.S. Managing Director and U.S. Head of Electrification of ABB Group, a global technology company, operating mainly in areas of electrification, robotics, power, and automation. Prior to joining ABB Group, Ms. Sylvester spent more than 30 years at GE, serving most recently as President and Chief Executive Officer of Current, a digital power service business that delivers integrated energy systems.

Prior to this Ms. Sylvester was President and Chief Executive Officer of GE Lighting a leading global lighting provider and prior President and Chief Executive Officer of GE Intelligent Platforms, an Industrial Automation provider. Ms. Sylvester began her GE career in supply chain where she held a series of progressively more responsible roles including Director of Sourcing for GE Lighting in Budapest Hungary and Global Sourcing Director for GE Lighting. |

Ms. Sylvester brings to our Board significant experience transforming industrial businesses and extensive knowledge regarding product development and marketing at an international company. | ||||||

Class I Directors with Terms Expiring in 2024

Name | Age | Position with Vontier | Director Since | |||||

Karen C. Francis |

| 59 |

| Director | September 2020 | |||

Mark D. Morelli |

| 58 |

| Chief Executive Officer and Director | October 2020 | |||

Karen C. Francis

Director

Age: 59 Director Since: September 2020 Board Chair Committees: Compensation and Management Development |

Karen C. Francis has served as a member of our Board of Directors since September 2020 and serves as Senior Advisor to TPG Capital and is an independent director for private equity and venture capital funded companies in Silicon Valley, including Wind River and Nauto. In 2021, Ms. Francis received her CERT Certificate in Cybersecurity Oversight from the National Association of Corporate Directors. Ms. Francis has served on the Board of Directors of TuSimple Holdings, Inc. (NASDAQ: TSP) since December 2020 and serves as a member of the

Prior to that, she served as a director of The Hanover Insurance Group, Inc. from May 2014 to May 2017 and AutoNation, Inc. from February 2016 to April 2018. In addition, Ms. Francis served as Chief Executive Officer of AcademixDirect, Inc., a technology innovator in education, from 2009 to 2014 and as its Executive Chairman from 2009 to 2017. From 2004 to 2007, Ms. Francis was Chairman and Chief Executive Officer of Publicis & Hal Riney, based in San Francisco and part of the Publicis global advertising and marketing network. From 2001 to 2002, she served as Vice President of Ford Motor Company, where she was responsible for the corporate venture capital group, as well as global e-business strategies, customer relationship management and worldwide export operations. From 1996 to 2000, Ms. Francis held several positions with General Motors, including serving as General Manager of the Oldsmobile Division. |

| 2022 Proxy Statement | 15 |

Proposal 1. Election of Directors

Ms. Francis brings to our Board her experience as a Chief Executive Officer, director, strategic advisor and investor with a deep knowledge of corporate governance and a strong track record of successfully building companies and businesses across multiple industries and sizes. | ||||||

Mark D. Morelli

Chief Executive Officer and Director

Age: 58 Director Since: October 2020 Committees: None |

Mark D. Morelli has served as our President and Chief Executive Officer since January 2020. Mr. Morelli previously served as President and Chief Executive Officer of Columbus McKinnon Corporation from February 2017 to January 2020 and prior to that served as President and Chief Operating Officer of Brooks Automation, Inc. from January 2012 to March 2016. Prior to serving at Brooks Automation, Inc., Mr. Morelli was the Chief Executive Officer of Energy Conversion Devices, an alternative energy company (which voluntarily filed a petition for relief under Chapter 11 of the U.S. Bankruptcy Code within one year after the date on which Mr. Morelli ceased to serve as its Chief Executive Officer). Prior to that, Mr. Morelli served in various positions with United Technologies Corporation from June 1993 to September 2007, where he progressed through product management, marketing, strategy and increasing responsibilities of general management. Mr. Morelli began his career as a U.S. Army officer and helicopter pilot. |

| 16 | 2022 Proxy Statement |  |

| Corporate Governance | ||||

Corporate Governance Guidelines, Committee Charters and Code of Conduct

As part of its ongoing commitment to good corporate governance, Vontier’s Board has adopted Corporate Governance Guidelines setting forth the Board’s corporate governance practices and adopted written charters for each of the Audit Committee, the Compensation and Management Development Committee and the Nominating and Governance Committee. The Board has also adopted our Code of Conduct that includes, among others, a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation and Management Development Committee Charter, Nominating and Governance Committee Charter, and Code of Conduct referenced above are each available in the “Investors – Governance” section of our website at www.vontier.com.

Board Leadership Structure, Risk Oversight and Management Succession Planning

Board Leadership Structure

The Board has separated the positions of Chair and CEO because it believes that the separation of the positions best enables the Board to ensure that our businesses, risks, opportunities and affairs are managed effectively and in the best interests of our stockholders.

Our Board has selected Karen C. Francis, an independent director, as its Chair, in light of Ms. Francis’ independence and her deep experience and knowledge with corporate governance, board management, shareholder engagement and risk management as well as her experience with Vontier’s diverse businesses and industries.

As the independent Chair of the Board, Ms. Francis leads the activities of the Board, including:

Calling, and presiding over, all meetings of the Board;

Together with the CEO and the Corporate Secretary, setting the agenda for the Board;

Calling, and presiding over, the executive sessions of non-management directors and of the independent directors;

Advising the CEO on strategic aspects of the Company’s business, including developments and decisions that are to be discussed with, or would be of interest to, the Board;

Acting as a liaison as necessary between the non-management directors and the management of the Company; and

Acting as a liaison as necessary between the Board and the committees of the Board.

In the event that the Chair of the Board is not an independent director, the Corporate Governance Guidelines provide that the independent directors, upon recommendation from the Nominating and Governance Committee, will select, by majority vote, an independent director to serve as the Lead Independent Director with the authority to:

Preside over all meetings of the Board at which the Chair is not present, including the executive sessions;

Call meetings of the independent directors;

Act as a liaison as necessary between the independent directors and the CEO; and

Advise with respect to the Board’s agenda.

The Board’s non-management directors meet in executive session following the Board’s regularly-scheduled meetings, with the executive sessions chaired by the independent Chair. In addition, the independent directors meet as a group in executive session at least once a year.

Risk Oversight

The Board’s role in risk oversight at the Company is consistent with the Company’s leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company.

| 2022 Proxy Statement | 17 |

Corporate Governance

In determining to separate the position of the CEO and the Chair, and in determining the appointment of the Chair of the Board and the Chairs of the committees of the Board, the Board and the Nominating and Governance Committee considered the implementation of a governance structure and appointment of chairpersons with appropriate and relevant risk management experience that would enable Vontier to efficiently and effectively assess and oversee its risks.

Risk Oversight by the Board of Directors

The Board oversees the Company’s risk management processes directly and through its committees. In general, the Board oversees the management of risks inherent in the operation of the Company’s businesses, the implementation of its strategic plan, its acquisition and capital allocation program, its capital structure and liquidity and its organizational structure, and also oversees the Company’s risk assessment and risk management policies.

Risk Oversight by the Committees

⬛ AUDIT COMMITTEE |

The Audit Committee oversees risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks. The Audit Committee also assists the Board in overseeing the Company’s risk assessment and risk management policies. Finally, the Audit Committee oversees our cybersecurity risk management and risk controls.

| |

⬛ COMPENSATION AND MANAGEMENT DEVELOPMENT COMMITTEE

| The Compensation and Management Development Committee oversees risks associated with the Company’s compensation policies and practices.

| |

⬛ NOMINATING AND GOVERNANCE COMMITTEE

|

The Nominating and Governance Committee oversees risks associated with corporate governance, board management and environmental, social and governance reporting.

|

Each committee reports to the full Board on a regular basis, including as appropriate, with respect to the committee’s risk oversight activities. In addition, since risk issues often overlap, committees from time to time request that the full Board discuss particular risks.

Cybersecurity

The Board has delegated to the Audit Committee the responsibility of exercising oversight with respect to the Company’s cybersecurity risk management and risk controls. Consistent with such delegation, our Chief Information Officer provides a report to the Audit Committee on a quarterly basis, and to the Board on an annual basis, regarding the Company’s cybersecurity program, including the Company’s monitoring, auditing, implementation and communication processes, controls, and procedures.

Enterprise Risk Committee

The Company’s Enterprise Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts, and, on at least an annual basis, provides a report to the Board and provides a report of the process to the Audit Committee.

Board Evaluation

In 2021, we engaged an outside advisor to conduct a comprehensive Board self-evaluation to assess the effectiveness of our Board, committees and members. The process was facilitated by an independent third party to preserve integrity and anonymity of the Board members. The evaluation process facilitator met with each director individually to obtain and compile responses to the

| 18 | 2022 Proxy Statement |  |

Corporate Governance

evaluation, which included feedback from Board members on other Board members, for review by the Board. The results were used to address the evolving needs of the company. The evaluation aims (1) to find opportunities where our Board and committees can improve their performance and effectiveness, (2) to assess any need to evolve the composition and expertise of our Board, and (3) to assure that our Board and committees are operating in accordance with our Corporate Governance Guidelines and committee charters.

Management Succession Planning

The entire Board oversees the recruitment, development, and retention of our executive officers, including oversight of management succession planning. The Board and its committee members engage and assess our executive officers and high-potential employees during management presentations and periodic informal meetings.

| 2022 Proxy Statement | 19 |

Corporate Governance

Board of Directors and Committees of the Board

In 2021, the Board met eight times and acted by unanimous written consent six times. All directors attended more than 90% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served during 2021. As a general matter, directors are expected to attend annual meetings of stockholders.

Committee Membership

The membership of each of the Audit, Compensation and Management Development and Nominating and Governance committees as of April 1, 2022 is set forth below.

Name of Director | Audit | Compensation and Management Development | Nominating and Governance | |||

Gloria R. Boyland | Member | Chair | ||||

Robert L. Eatroff | Member | |||||

Karen C. Francis | Member | |||||

Martin Gafinowitz | ||||||

Christopher J. Klein | Chair | Member | ||||

Andrew D. Miller | Chair | Member | ||||

Mark D. Morelli | ||||||

Maryrose Sylvester | Member | Member | ||||

The members of the Audit Committee are Messrs. Miller and Eatroff and Mses. Boyland and Sylvester. Mr. Miller serves as chair of the Audit Committee. The Board has determined that Mr. Miller is an “audit committee financial expert” for purposes of the rules of the SEC. In addition, the Board has determined that Messrs. Miller and Eatroff and Mses. Boyland and Sylvester are independent, as defined by the rules of the NYSE and Section 10A(m)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”). The Audit Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting. In 2021, the Audit Committee met eight times and acted by unanimous written consent once. The Audit Committee is responsible for assisting the Board in:

assessing the qualifications and independence of our independent auditors;

appointing, compensating, retaining, and evaluating our independent auditors;

overseeing the quality and integrity of our financial statements and making a recommendation to the Board regarding the inclusion of the audited financial statements in Vontier’s Annual Report on Form 10-K;

overseeing our internal auditing processes;

overseeing management’s assessment of the effectiveness of our internal control over financial reporting;

overseeing management’s assessment of the effectiveness of our disclosure controls and procedures;

overseeing risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks;

overseeing our risk assessment and risk management policies;

overseeing our compliance with legal and regulatory requirements;

overseeing our cybersecurity risk management and risk controls;

overseeing any significant issues involving the safety of the Company’s facilities and products; and

overseeing swap and derivative transactions and related policies and procedures.

| 20 | 2022 Proxy Statement |  |

Corporate Governance

Furthermore, as of the date of this proxy statement, no Audit Committee member serves on the audit committee of more than three public companies.

Compensation and Management Development Committee

The members of the Compensation and Management Development Committee are Ms. Francis and Messrs. Klein and Miller. Mr. Klein serves as the Chair of the Compensation and Management Development Committee. The Compensation and Management Development Committee met eight times in 2021 and acted by unanimous written consent six times. The Compensation and Management Development Committee discharges the Board’s responsibilities relating to the compensation of our executive officers, including setting goals and objectives for, evaluating the performance of, and approving the compensation paid to, our executive officers. The Compensation and Management Development Committee is also responsible for:

determining and approving the form and amount of annual compensation of the CEO and our other executive officers, including evaluating the performance of, and approving the compensation paid to, the CEO and other executive officers;

reviewing and making recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercising all authority with respect to the administration of such plans;

reviewing and making recommendations to the Board with respect to the form and amounts of director compensation;

overseeing and monitoring compliance by directors and executive officers with our stock ownership requirements;

overseeing risks associated with our compensation policies and practices; and

overseeing our engagement with stockholders and proxy advisory firms regarding executive compensation matters.

Each member of the Compensation and Management Development Committee is:

| • A “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act; and

| |||||

• Based on the determination of the Board, independent under NYSE listing standards and under Rule 10C-1 under the Securities Exchange Act.

| ||||||

Compensation Committee Interlocks and Insider Participation

During 2021, none of the members of the Compensation and Management Development Committee was an officer or employee of Vontier. No executive officer of Vontier served on the Compensation and Management Development Committee (or other board committee performing equivalent functions) or on the board of directors of any entity having an executive officer who served on the Compensation and Management Development Committee.

Nominating and Governance Committee

The members of the Nominating and Governance Committee are Mses. Boyland and Sylvester and Mr. Klein. Ms. Boyland serves as the Chair of the Nominating and Governance Committee. The Board has determined that Mses. Boyland and Sylvester and Mr. Klein are independent, as defined by the rules of the NYSE. The Nominating and Governance Committee met six times in 2021 and acted by unanimous written consent two times. The Nominating and Governance Committee is responsible for:

reviewing and making recommendations to the Board regarding the size and composition of the Board;

assisting the Board in identifying individuals qualified to become Board members;

assisting the Board in identifying characteristics, skills, and experiences for the Board with the objective of having a Board with diverse backgrounds, experiences, skills, and perspectives;

proposing to the Board the director nominees for election by our stockholders at each annual meeting;

assisting the Board in determining the independence and qualifications of the Board and Committee members and making recommendations to the Board regarding committee membership;

| 2022 Proxy Statement | 21 |

Corporate Governance

developing and making recommendations to the Board regarding a set of corporate governance guidelines and reviewing such guidelines on an annual basis;

overseeing compliance with the corporate governance guidelines;

overseeing our environmental, social and governance reporting;

assisting the Board and the committees in engaging in annual self-assessment of their performance;

oversee the orientation process for newly elected members of the Board and continuing director education; and

administering our Related Person Transactions Policy.

The Board has adopted a written charter for each of the Audit Committee, the Compensation and Management Development Committee and the Nominating and Governance Committee. These charters are posted on our website.

The Nominating and Governance Committee recommends to the Board director candidates for nomination and election at the annual meeting of stockholders and, in the event of vacancies between annual meetings of stockholders, for appointment to fill such vacancies.

Board Membership Criteria

In assessing the candidates for recommendation to the Board as director nominees, the Nominating and Governance Committee will evaluate such candidates against the standards and qualifications set out in our Corporate Governance Guidelines, including:

| Personal and professional integrity and character | |

| Prominence and reputation in the candidate’s profession | |

| Skills, knowledge, diversity of background and experience, and expertise (including business or other relevant experience) useful and appropriate to the effective oversight of our business | |

| The extent to which the interplay of the candidate’s skills, knowledge, expertise and diversity of background and experience with that of the other Board members will help build a Board that is effective in collectively meeting our strategic needs and serving the long-term interests of the stockholders | |

| The capacity and desire to represent the interests of the stockholders as a whole | |

| Availability to devote sufficient time to the affairs of Vontier | |

Stockholder Recommendations

Stockholders may recommend a director nominee to the Nominating and Governance Committee. A stockholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under “—Communications with the Board of Directors” with whatever supporting material the stockholder considers appropriate. If a prospective nominee has been identified other than in connection with a director search process initiated by the Nominating and Governance Committee, the Nominating and Governance Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. The Nominating and Governance Committee’s determination of whether to conduct a full evaluation is based primarily on the Nominating and Governance Committee’s view as to whether a new or additional Board member is necessary or appropriate at such time, and the likelihood that the prospective nominee can satisfy the evaluation factors described above under “—Board Membership Criteria” and any such other factors as the Nominating and Governance Committee may deem appropriate. The Nominating and Governance Committee takes into account whatever information is provided to it with the recommendation of the prospective candidate and any additional inquiries the Nominating and Governance Committee may in its discretion conduct or have conducted with respect to such prospective nominee. The Nominating and Governance Committee evaluates director nominees in the same manner whether a stockholder or the Board has recommended the candidate.

| 22 | 2022 Proxy Statement |  |

Corporate Governance

Majority Voting for Directors

At any meeting of stockholders for which Vontier’s Secretary receives a notice that a shareholder has nominated a person for election to the Board in compliance with our Amended and Restated Bylaws and such nomination has not been withdrawn on or before the tenth day before we first mail our notice of meeting to our stockholders, the directors will be elected by a plurality of the votes cast (which means that the nominees who receive the most affirmative votes would be elected to serve as directors).

Communications with the Board of Directors

Stockholders and other parties interested in communicating directly with the Board or with individual directors, the independent Chair of the Board or, if the Chair is not independent, the Lead Independent Director, or the non-management directors as a group may do so by addressing communications to the Board, to the specified individual director or to the non-management directors, as applicable, c/o Secretary, Vontier Corporation, 5438 Wade Park Boulevard, Suite 600, Raleigh, North Carolina 27607.

Environmental, Social and Governance (“ESG”)

Environmental, Social and Governance Overview

While our operating companies serve a variety of end markets, we are all guided by our shared purpose—We are Mobilizing the Future to Create a Better World. Our shared purpose and values, which are embedded deep within our culture—The Vontier Way, guide our ESG strategy just as they guide all of our strategic priorities. They influence the new products we create, how we operate, and how we engage with our stakeholders. They help us attract and retain employees who share our values and our commitment to a sustainable future.

In the context of ESG, we have three powerful accelerators. First, our operating companies have a direct impact on pressing global issues like transportation safety and inclusivity, alternative energy and sustainable infrastructure. Second, our deeply ingrained culture of continuous improvement, driven by the Vontier Business System, gives us the tools and mindset to continually learn from our successes and failures, grow as individuals and teams, and harness process rigor to move from good intentions to accountability and transparent results. And third, we have a unique ESG philosophy that accelerates our ESG efforts and the positive impact it has on all of our stakeholders.

Our ESG Philosophy

We philosophically believe that anchoring our ESG program in a Better Team will more powerfully drive Better Innovations, a Better Planet, and a Better Society. This ESG framework and philosophy prioritizes our employees first. By focusing on our employees’ safety and well-being, sense of belonging and purpose, and growth and development, we create a Better Team, which will fully unleash our collective potential, accelerate progress for all stakeholders and fulfill our purpose to Mobilize the Future to Create a Better World.

| 2022 Proxy Statement | 23 |

Corporate Governance

Our ESG Oversight

We created our ESG governance structure in 2020. The Vontier Board has oversight of our ESG program while the Nominating and Governance Committee oversees ESG disclosures. We created an ESG Executive Council consisting of the entire senior leadership team that oversees ESG at the management level, and an ESG Advisory Team that consists of cross-functional and cross-operating company workstream owners in areas like cyber, environmental, health, safety and security, employee benefits, and governance.

Our Global Commitment

We completed a comprehensive, data-driven analysis to identify our top ESG priorities, including environmental impact, a fair and inclusive workplace, employee well-being, health and safety, integrity and compliance, governance, innovation and digitization and finding and nurturing talent. We have invested in AI-powered tools for rigorous, ongoing materiality assessments. Additionally, we have been accepted as a signatory to the United Nations (“UN”) Global Compact, the world’s largest corporate sustainability initiative. It is our intent to advance the broader goals of the UN, including the Sustainable Development Goals (“SDGs”). We have prioritized the following four SGDs where we think we can make the most impact and that reflect our desire to lead and solve problems on a global scale.

Environmental Stewardship

We hold ourselves to high standards of environmental stewardship and continuously look for ways to raise the bar. In addition to measuring and reducing our own environmental foot-printfootprint through company-wide initiatives like energy kaizens, we set greenhouse gas reduction targets. In 2021, we committed to reducing our absolute Scope 1 and 2 greenhouse gas (GHG) emissions by 45% by 2030, and to achieving Net Zero by 2050 in support of the Paris Climate Agreement. We are aligning our goals with climate science and the methodology defined by the Science Based Target initiative (SBTi) to reduce GHG emissions at the pace and scale consistent with keeping warming below 1.5°C. We are committed to maximizing our global impact through continuous improvement and innovating the road ahead.

Inclusion, Diversity and Equity

We are committed to sustaining an inclusive and diverse culture and team and have a seasoned Inclusion, Diversity & Equity (“ID&E”) executive leading this priority and vision. We stood-up a cross-functional, global ID&E Council, to help drive and accelerate our ID&E priorities. With input from employees around the world, we created our ID&E vision:

| 24 | 2022 Proxy Statement |  |

Corporate Governance

I belong here. We celebrate the uniqueness of all people as it is the core of who we are, and the fuel that drives our success. We established the following ID&E pillars that will guide strategy:

Our Employee Resource Groups (“ERG”) continue to create community and connections that our employees desire, this is evident by the continuing increase in participation in ID&E initiatives and increase in ERG membership rates.

Community and Social Impact

Externally, we make a positive impact our communities in a variety of ways, including through our Day of Caring, Vontier Foundation and Scholarship Program as well as through the following:

|  |  |  |  | ||||

| Proud signatory to the UN Global Compact | 100% score on the 2022 Corporate Equality Index | Proud signatory to the CEO Action for Diversity & Inclusion Pledge | Proud member of The Valuable 500 | Proud 2022 Military Friendly Employer and Military Friendly Brand |

In 2021, over 2,000 Vontier employees around the world participated in Day of Caring initiatives supporting disaster and COVID-19 relief, education, and fighting hunger.

Environmental, Health, Safety and Security

In an effort to further prioritize Environmental, Health, Safety and Security (“EHSS”), we created an elevated global EHSS leadership role in 2020 and expanded the function to include physical security. This Vice President of EHSS reports directly to Vontier’s Senior Vice President, Chief Legal and Administrative Officer. We have a company-wide goal to achieve U.S. Occupational Safety and Health Administration top quartile for Total Recordable Injury Rate (“TRIR”) and Days Away, Restricted, Transferred (“DART”) case rate based on their industry classification. We define TRIR as recordable incidents (per the Occupational Health and Safety Administration guidelines) multiplied by 200,000 and divided by total hours worked.

| 2022 Proxy Statement | 25 |

Corporate Governance

Employee Well-being, Safety and Health

We are continually focused on the physical and emotional safety and well-being of our employees. The safety, health and well-being of our employees has been and continues to be a priority during the COVID-19 pandemic. Our global cross-functional COVID-19 Task Force protects the health and safety of our employees and ensures support for our customers. We took a number of actions starting in 2020, including ensuring pay continuity for quarantine periods across the globe and enabling and mandating remote work where possible, while ensuring that our essential manufacturing employees and leaders had the education, tools, and support needed to stay safe on the job. We have flexed shifts to accommodate childcare needs and reduce building intensity loads. Using the Vontier Business System and virtual project management tools, our COVID-19 Task Force collaborates to create standard work and processes like temperature checks, daily health attestations and contact tracing drills to keep our employees safe and ensure our customers continue receiving support.

| 26 | 2022 Proxy Statement |  |

| Certain Relationships and Related Transactions | ||||

Under our Related Person Transactions Policy adopted by the Board, the Nominating and Governance Committee of the Board is required to review and, if appropriate, approve all related person transactions prior to consummation whenever practicable. If advance approval of a related person transaction is not practicable under the circumstances or if our management becomes aware of a related person transaction that has not been previously approved or ratified, the transaction is submitted to the Nominating and Governance Committee at its next meeting. The Nominating and Governance Committee is required to review and consider all relevant information available to it about each related person transaction, and a transaction is considered approved or ratified under the policy if the Nominating and Governance Committee authorizes it according to the terms of the policy after full disclosure of the related person’s interests in the transaction. Related person transactions of an ongoing nature are reviewed annually by the Nominating and Governance Committee. The definition of “related person transactions” for purposes of the policy covers the transactions that are required to be disclosed under Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act.

Relationships and Transactions

On October 9, 2020, we completed the separation (the “Separation”) of Vontier from Fortive Corporation (“Fortive”). In connection with the Separation, our subsidiaries that currently operate our businesses and the corresponding assets and liabilities were transferred to Vontier, which, prior to such transfer, were held by Fortive. Following the Separation, Fortive and Vontier operate as separate publicly-traded companies and currently, neither entity has any ownership interest in the other. In connection with the Separation, Fortive and Vontier entered into various agreements to effect the Separation and provide a framework for their relationship after the Separation, including an employee matters agreement, a tax matters agreement, an intellectual property matters agreement, a license agreement with respect to the Fortive Business System (“FBS”), a proprietary set of business processes and methodologies that are designed to continuously improve business performance, and a transition services agreement. These agreements provide for the allocation between Fortive and Vontier of assets, employees, liabilities and obligations (including investments, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after the Separation and govern certain relationships between Fortive and Vontier after the Separation. In addition, following the Separation, certain of our subsidiaries sell products and services to, or purchase products and services from, Fortive from time to time in the ordinary course of business and on an arm’s length basis.

| 2022 Proxy Statement | 27 |

| Director Compensation | ||||

Summary of Director Compensation

Pursuant to our non-employee director compensation policy, each of our non-management directors will receive the following compensation:

An annual retainer of $100,000, payable in cash and/or restricted stock units (“RSUs”) pursuant to an election made by each director in the prior year under the terms of our Non-Employee Directors’ Deferred Compensation Plan, as described more fully below (the “Election”).

An annual equity award with a target award value of $175,000, comprised of RSUs. The RSUs will vest upon the earlier of (1) the first anniversary of the grant date, or (2) the date of, and immediately prior to, the next annual meeting of our stockholders following the grant date. The distribution of RSUs may be deferred under the terms of our Non-Employee Directors’ Deferred Compensation Plan.

Reimbursement for out-of-pocket expenses, including travel expenses and expenses for education, related to the director’s service on the board.

In addition to the foregoing amounts:

The Board chair will receive an annual retainer of $92,500, payable pursuant to the Election and an annual equity award with a target value of $92,500 (divided either equally between options and RSUs under the Plan or comprised solely of RSUs, in each case, as described above for purposes of the annual equity award).